A Tale of Two Sentiments

I've been around the power and renewables industries for over 15 years now. In that time, I've seen its popularity boom and bust.

From 2008-2012, it was around the promise of solar and other alternative energy technologies. After that, the hype went away and funding dried up.

Then, the climate movement really took off during COVID and the space became popular again. The very best builders and investors stayed this time, even when the hype went away. The generalists and tourists moved on to AI - which brings me to today.

For the first time in my career, power is now viewed as a competitive advantage in an industry that could define America's future as a global competitor.

For someone who's now seen a few cycles in the space and questioned if I was spending my time in the right sector - that's amazingly cool.

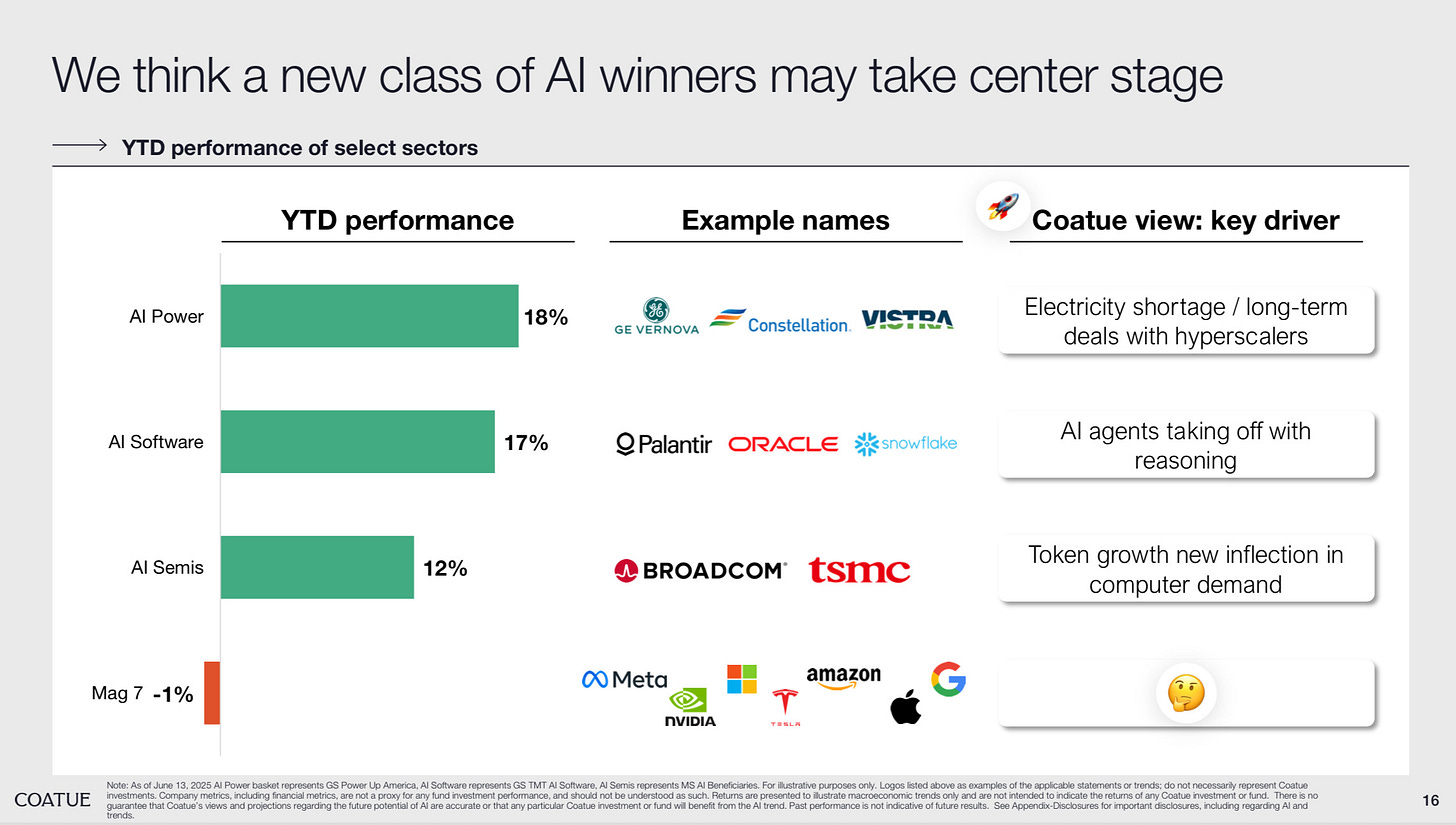

Coatue's latest East Meets West highlights this change - declaring energy is the new oil and highlighting power OEMs and generators as the top performers in the public markets through 2025.

The shift is undeniable when you look at the numbers. Data centers alone are expected to consume 8% of total U.S. electricity by 2030, up from 3% today. The hyperscalers aren't just buying renewable energy certificates anymore; they're directly contracting with utilities, building their own generation assets, and even restarting nuclear plants (though I question the seriousness of this).

The hyperscalers and AI upstarts consuming power aren't the cleantech tourists of 2010 chasing subsidies - they're building for decades, not election cycles. Utilities, grid operators, power generation companies - they're all suddenly mission-critical infrastructure for the technologies that will define the next century.

And yet, with all that positivity, the renewables market currently sits in a state of uncertainty as the Republican tax bill makes its way through congress. Tax credits for wind and solar are up in the air with varying reports on where it could all ultimately land.

Make no mistake about it - there will be some rough times. But, sectors are ultimately more healthy when they can survive based on economics. AI’s power needs creates that opportunity like nothing renewables has ever seen.

And, I'll say it again, power is a competitive advantage in the industry that defines the next set of global winners. So, regardless of what comes out of congress the biggest companies in AI and the countries supporting them will ultimately come down to abundant, cheap power.

That’s what gives me hope about the future of these industries - whoever can deliver the most reliable, lowest-cost electrons at scale wins. Everything else will ultimately be proven to be noise.